Come on, admit it , are you one of those who find it very difficult to set aside your salary to save? If so, it looks like you need to learn the right saving tips, here. In fact, saving is not as hard as you might think. Especially if you don’t have any dependents yet.

Even more than that, you can still have fun and do self-rewards while saving, you know ! How to? Here is the full explanation.

Why Should You Set aside Your Salary for Savings?

Getting paid is one of the most enjoyable things about being a worker. With a salary, we can buy all our needs and desires. But, did you know that there will come a time when you are grateful to have savings ?

Read Also : 6 Tips for Playing Crypto for Beginners

Regardless of your salary, there are several logical reasons why you should be willing to set aside a portion of your salary for savings, here are some of them:

1. Coping with Job Loss

Like life, the world of work is also full of unpredictable surprises. You never know your future career. For example, it turns out that the company is doing mass layoffs or you have to resign for one reason or another.

Well, when you experience this, you will feel the benefits of saving. Your financial situation is guaranteed and can help you survive at least until you get a new job.

2. Prepare an Emergency Fund

If one day you experience something unwanted, or need a large amount of funds, you don’t need to deal with Pinjol. You can use savings funds to overcome this situation.

3. Pension Fund

Of course you don’t want to work forever, do you? When you enter retirement, you won’t be confused about how to carry out your daily life as a retiree. You can retire in peace with the savings you have.

4. Can Have Fun

Almost every working day, if you want, you can go on a trip to your dream place, for example abroad. Well, surely that requires a lot of funds, so you need to save up to be able to do it.

5. Have Your Own Home

Have your own house, It’s my dream, Mas! Imagine, at a young age, you can already have your own. Surely this is very proud. In order to make this happen, you can start by saving slowly from your monthly salary.

Read Also : 8 Ways to Manage Finances properly and wisely

The Right Way to Save According to Financial Experts

Many workers find it difficult to save because they are driven to be consumptive when they receive a salary.

Without thinking twice, he (and maybe you including) buys things that he doesn’t really need. Then justify their actions by saying “it’s okay how come this is self-reward”. This pattern eventually repeats every payday, which ends up being unable to set aside your salary to save.

Yes, there is nothing wrong with self-rewarding . However, you have to know when is the right time to do self-reward , and to what extent. Difficult? Of course. But, to make it easier for you to do it, below are several ways to save the right according to financial experts.

1. Set Automatic Debit to a Savings Account

An author and financial expert, Farnoosh Torabi says that saving with automatic transfers is the right and most effective way of saving. At least 10 percent of your salary should be transferred by auto debit to a savings account. That way you have no reason to forget.

Set consistent transfer amounts and dates that go directly to your savings account. In this way, you also learn to be disciplined in saving.

2. It’s OK to Start with a Small Amount

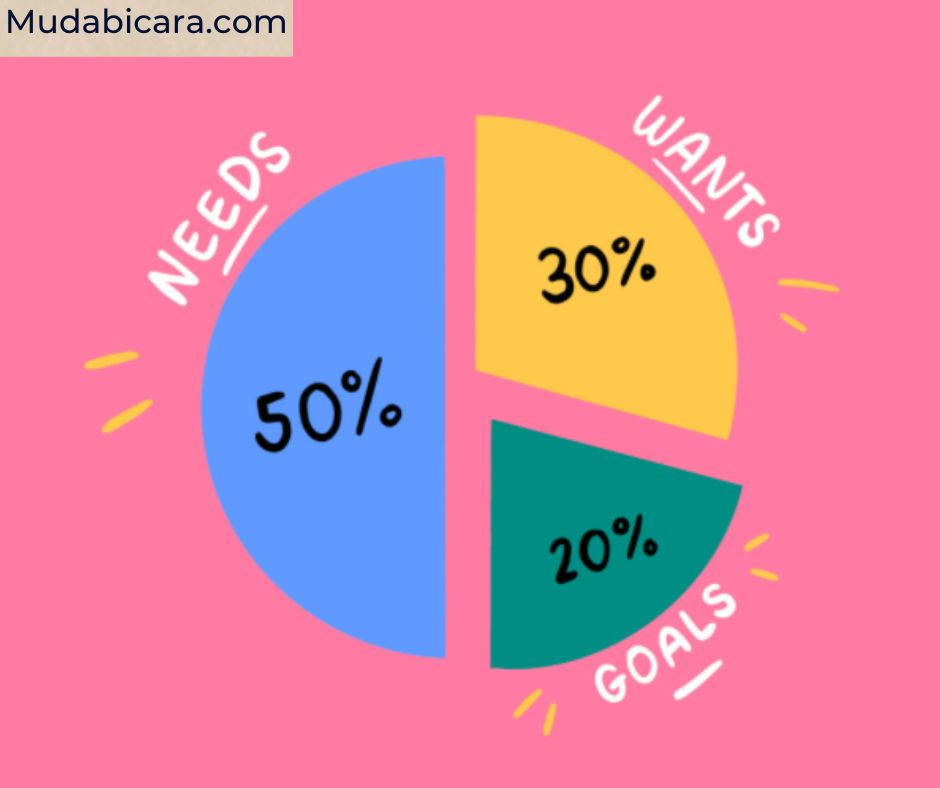

Elizabeth Warren, a senate from America, once created the 50/30/20 budget rule method , which will allow you to balance needs, self-rewards , and savings.

According to Warren, to keep saving, you should divide your monthly income on a 50/30/20 basis. 50% to meet daily needs, 30% self-reward , and 20% to save .

But if you can’t do the method like Warren above, it doesn’t matter if you save with the smallest percentage first, but regularly.

If you can’t allocate 20 percent of your salary for savings, try starting by setting aside 2 percent of your salary. But make sure your saving percentage increases until it reaches 20 percent of salary.

3. Collecting and Saving Change

Don’t take change for granted! According to Edelman Financial Services CEO Ric Edelman, saving can start from collecting change in change.

If you usually take this money for granted because it’s a small amount, from now on try to collect it. This will encourage your habit of setting aside money.

Read Also : What is Cryptocurrency? Definition, Types, and How to practice

4. Create a Separate Account

Another saving tip is to create a new account that you specify as a savings account. By separating the savings account from the daily account, the daily money and the amount of savings are not mixed. This can save your money from consumptive traits.

5. Set Saving Goals

One of the reasons why people often fail to save is because they have no goals. In fact, with embedded goals, there will be motivation that pumps enthusiasm to set aside savings.

So every time you save, make sure you have set a target for what you want to use the savings for, for example to buy a house, retire funds, take a vacation, or send your parents to Hajj.

Tips for Saving for a Small Salary

As the financial experts have said before, no salary is too small to set aside! No matter how small your income is, always regularly set aside some of it for savings. Even the first thousand and two thousand is fine, as long as you consistently do it. Below are some tips for saving even a small salary that might help you.

1. Prioritize Money for Saving

When payday arrives, try to immediately separate the funds for savings first before you use the money. Don’t wait for the rest of your salary, because there will never be any left over, instead the money is even threatened with less and you fail to save.

If you can afford it, try setting aside 10 to 30 percent of your salary.

2. Use Easy Savings Methods

So that you don’t feel like saving is hard, try using a method that you think is easy. If setting aside 10 percent is too much, try starting with a small nominal or a change. Make savings with a piggy bank.

Or the method of saving by date. The point is that the nominal money stored follows the date, and starts from the 30th or 31st of each month. For example, January has 31 days. So, on the 31st you save IDR 31,000, and so on.

3. Create a Budget

If you have set aside savings, record all the needs needed per month. Systematic budgeting will help to prioritize spending and maintain a balance between spending and saving.

When you make a monthly budget, set priority needs, avoid prioritizing wants.

4. Create Expenditure Notes

The right way to save is not to make yourself miserable. Try to check and record every bill, receipt. Calculate all routine expenses such as transportation costs, electricity bills, as well as monthly shopping receipts.

Then calculate all of these costs, adjusted for income. All of this aims so that you can allocate needs efficiently.

5. Avoid trivial expenses

Small expenses that feel trivial can also be a barrier for you to save. For example, if you have a habit of buying iced coffee at a cafe every day. Maybe this feels cheap, but if you do the math and accumulate how much money is spent on it for one month.

Think again, are these expenses necessary? Try to find a more economical alternative.

6. Budget Funds for Socializing

Socializing is necessary, especially when you are already working, socializing can build your connections. But most of the workers do not budget for the need to socialize so they tend to be wasteful because of this. Therefore, from now on, try to budget for the need to socialize.

For those of you who have a salary of IDR 4 million, try setting aside 10 percent of your salary, which is around IDR 400,000 each month for socializing purposes, and try not to exceed that.

7. Set aside 200 thousand for Emergency Fund

Sometimes there are unforeseen needs. Like motorbikes that need service, broken glasses or other needs. So that you don’t take the money you have set aside for savings, try to prepare an emergency fund of around IDR 200,000.

Read Also :What is Tenor?Definition, Function, Category, and Determining Tips

Daily Savings Tips, You Can Do It!

Saving daily is a habit that is easy to do. The amount is not much, but this routine will allow you to have savings. Check out the full daily saving tips below:

1. Choose a Manual Saving Method

To get into the habit of saving consistently, try saving manually. What do you mean? When you complete a transaction with cash, at the end of the day try saving the change you got in the piggy bank.

It doesn’t matter a little or a lot, as long as it’s routine. The most important thing is that you can stem the desire to spend your daily expenses so that there is always money left to save.

2. Starting from a Small Nominal

You don’t have to start with a large nominal, a small nominal is also a good first step. This can build your commitment to get used to saving daily. For example, you can only save IDR 10,000 per day.

Maybe the nominal looks small, but if you are consistent and do it without breaking up then in 1 year, you can save 3.6 million.

3. Order meals in small portions

Another daily saving tip that you can do is try ordering food in small portions. This may sound trivial, but buying small amounts of food can prevent you from wasting your food or buying more food than you need.

4. Take advantage of various discounts

Try to take advantage of discounts to reduce costs or break your daily saving habits. How to? When you want to hangout with friends, spouse or family, look for places that have special discounts for students, parents, or member discounts. That way, your spending stays safe and you still have money to put in your piggy bank.

5. Limit Online Shopping

The biggest temptation that makes it difficult for us to save is shopping online , especially if there are big promos. However, you must be able to apply self-control so you don’t do impulsive buying .

There are several alternative ways to successfully limit yourself from online shopping , such as not installing more than one shopping app, turning off notifications, or reducing the time scrolling through the app.

Read Also :What is a Bond? Definition, Types, Advantages, and Terms

If you want to go more extreme, you can delete the shopping app altogether and only reinstall it if you need something.

That’s a complete guide on how to save the right way according to financial experts and tips on saving for various conditions. Believe me, one day your patience when saving will pay off.